U.K. to Create Blockchain Platform for TradFi Asset Trading

British company London Stock Exchange (LSE Group) plans to create the world’s first platform based on distributed ledger technology (DLT) for trading traditional financial assets.

A report in the Financial Times stated that the LSE Group analysts have been studying the potential of blockchain for a year and are ready to start developing a DLT platform for trading TradFi assets.

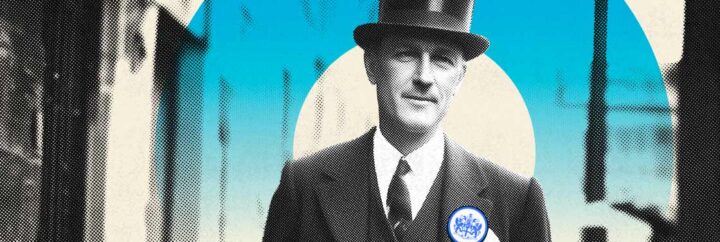

According to Murray Roos, LSE Group’s Head of Capital Markets, although the platform will be based on blockchain, it’ll have nothing to do with cryptocurrencies. As part of the project, DLT is designed to improve the efficiency of processes. He also noted that the project would be fully regulated.

Roos said that the LSE Group developers would build a public blockchain network on the basis of which the platform would operate, making the process of buying and selling traditional assets cheaper and more open.

Roos also noted that the company appreciated the potential of DLT and the successes that developers of blockchain solutions had achieved. He added that if the initiative is successful, the LSE Group will become the first global stock exchange to offer an ecosystem for TradFi investors based entirely on blockchain.

Recent studies have shown that DLT can bring significant benefits to TradFi companies and has the potential to transform traditional payment systems.