Bitcoin Recognized as Reserve Asset at State Level in U.S.

The state of New Hampshire officially approved the creation of a strategic Bitcoin reserve, becoming the first U.S. state to legalize the use of digital assets in government financial strategies.

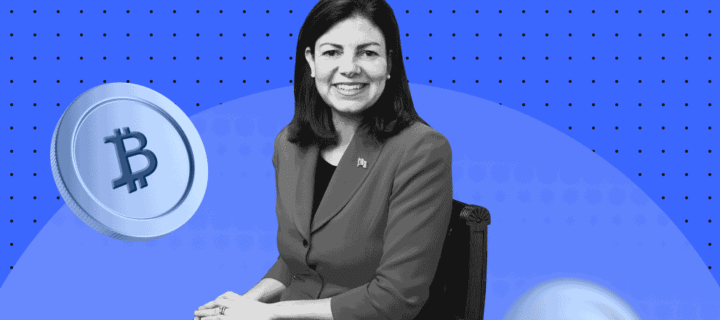

New Hampshire Governor Kelly Ayotte signed bill HB 302, which provides for the establishment of the Bitcoin & Digital Assets Reserve Fund. The law will take effect 60 days after signing.

According to the law, the state treasurer is authorized to acquire BTC and other digital assets with a market cap of over $500 billion for use as a strategic reserve. The total volume of digital assets must not exceed 5% of all state reserve funds. The assets will be held through U.S.-regulated custodial services.

New Hampshire became the first state in the U.S. to legalize the creation of a strategic Bitcoin reserve. According to Bitcoin Reserve Monitor, as of May 7, 2025:

- 18 states are considering similar bills;

- 2 states are in the discussion stage;

- 5 states rejected such initiatives.

The popularity of state-level Bitcoin reserves surged after U.S. President Donald Trump signed an executive order to create a federal strategic Bitcoin reserve using assets previously confiscated by federal agencies.

The possibility of including BTC in national reserves is also being explored internationally. For example, Czech authorities are studying Bitcoin’s potential as an asset to strengthen financial stability and independence, especially amid global economic shifts. Meanwhile, the European Central Bank rejected the idea of creating a Bitcoin reserve.

According to Max Krupyshev, CEO of CoinsPaid, BTC is becoming an increasingly attractive tool for governments seeking to diversify reserves and reduce dependence on traditional financial assets. He noted that Bitcoin can serve as a hedge asset during periods of national currency instability. “Such an initiative could be implemented by virtually any government if it sees a strategic advantage,” Max shared.