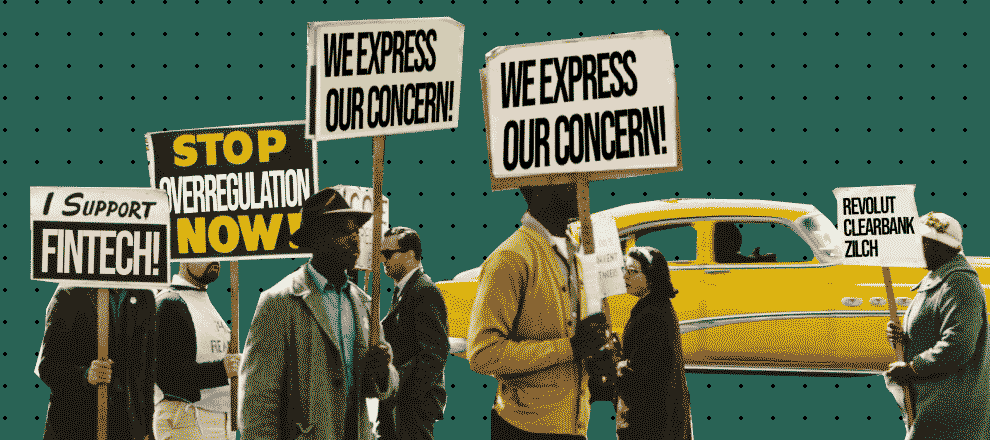

Leaders of the largest FinTech companies in the U.K. approached the government with complaints about excessive regulation that is stifling their development. Industry representatives are calling for a review of the rules so that the country can take a leading position in the global market for innovative financial technologies.

Reps from British FinTech companies, including Revolut, ClearBank, and Zilch, expressed concerns that the current regulatory framework in the United Kingdom negatively impacts their operations. This was reported by Bloomberg, citing sources present at a meeting between business leaders and Tulip Siddiq, Economic Secretary to the Treasury (EST) of the U.K.

Specifically, FinTech representatives claim that existing U.K. regulatory requirements:

- slow down the adoption of innovations in the sector;

- make it difficult to attract investments;

- hinder FinTech companies’ plans for IPOs and stock market entry.

Financial technologies play a key role in the U.K. economy. However, FinTech representatives argue that the lack of flexibility from regulators is obstructing their growth. They assert that the tightening of regulations, which began after the 2008 financial crisis, has significantly hampered the sector’s development. To avoid negative consequences, the requirements for FinTech companies must be reviewed and adapted to modern market trends.

During the meeting with government representatives, Francesca Carlesi, CEO of Revolut in the U.K., Charles McManus, CEO of ClearBank, and Philip Belamant, Head of Zilch Technology Ltd., proposed a number of measures to foster industry growth and its global competitiveness. Among these measures are:

- streamlining the licensing process;

- revising capital requirements;

- increasing support for innovative startups;

- accelerating the implementation of legislative changes.

Studies showed that the future of the U.K.’s financial sector depends on the development of tokenization technology; however, the authorities continue to tighten oversight on crypto companies.