Hype, Hedging, and Bull Market Amnesia: The State of Crypto — Midsummer 2024

The current state of the cryptocurrency market is driven by a combination of fading tailwinds from the Bitcoin halving and ETF approvals, and emerging headwinds such as high-profile Bitcoin sales and repayments, stalled regulations, and stable inflation data that has led to a rally in traditional markets.

Note: All ideas described below are presented for informational purposes only. They are not intended as investment advice. The author does not encourage the sale or purchase of any assets and is not responsible for decisions based on the material’s information.

Bitcoin Remains a Retail-Led Asset Class, At Least for Now

The halving and the ETF approvals had already been priced into the market, and the overall rally appears to have been led by retail investors on the back of the hype related to positive news rather than an influx of capital from institutions.

Retail-led rallies increase volatility, are driven by market sentiment, and can often be overdone. Despite this, the rally looks incredibly healthy so far from a technical perspective.

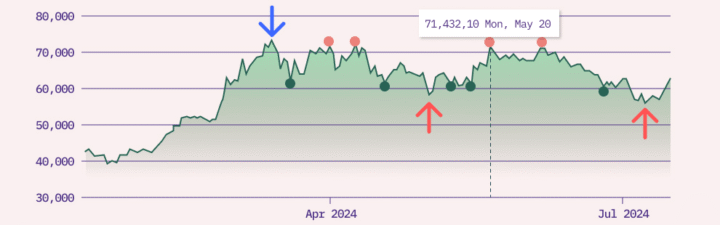

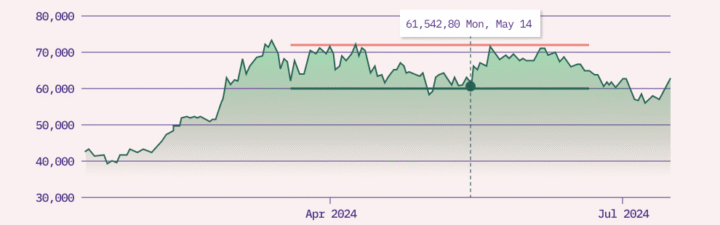

The chart above shows the six-month BTC chart with support marked in green and resistance in red. The blue arrow indicates the new high (which corresponds to the current resistance levels) and the red arrows indicated BTC breaking support levels.

Here’s a quick rundown of BTC’s price action over the last six months:

- March 13: Hits a new ATH at $73,135;

- March 16: Sold off, found support at the previous high above $65,000;

- March 19: Dropped to $61,900, breaking the previous high’s support;

- March 31: Rallied, attempted to break resistance at $71,255;

- April 3: Sold off, found support at $65,500;

- April 8: Made a second attempt to break resistance at $71,618;

- April 17: Sold off to $61,269;

- April 22–23: Couldn’t hold above the previous high at $66,000;

- May 1: Sold off to just above $58,000;

- May 8–14: Found support just above $61,000;

- May 20: Rallied to resistance at $71,400;

- May 21–June 3: Consolidated around $70,000;

- June 5: Fourth attempt to break the $71,000 resistance;

- June 24–July 3: Tried to find support above $61,000;

- July 7: Sold off to just below $56,000;

- July 15: Returned to the trading range at $62,786.

The local bottom sits just above $61,000. The resistance is above $71,000. Therefore, the current trading range is between $61,000 and $71,000.

The price looks relatively weak from a technical perspective, having faced resistance four times above $71,000 and having broken the support at $61,000 twice (the second time for more than ten days).

The news also supports more sellers than buyers in the short term, and the true test of the ETF capital will be in stabilizing prices and decreasing volatility. The ETFs have already accumulated more than 3% of the network, roughly 600,000 BTC. While this is significant, for perspective, the entire Mt.Gox hack resulted in a loss of 740,000 BTC, which will be compensated with a combination of 140,000 BTC, 138,000 BCH, and $510 million.

Publicly traded crypto miners have been consistently selling BTC and currently hold historically low levels in their reserves. These sell-offs included a single day outflow of 3,500 BTC in January 2024 following the ETF approval.

The German Government is selling Bitcoin in another high profile sale (editor’s note: The German government eventually sold all their BTC reserves, earning ~$2.9 billion).

Short-term traders also play a crucial role in the Bitcoin market by providing liquidity and influencing volatility. Their actions, driven by market sentiment, news, and technical analysis, can lead to rapid price movements and contribute to the overall dynamics of Bitcoin’s price. The goal of short-term traders is to capitalize on market trends, and they tend to be loyal only to returns, making them quick to jump in order to follow the trend.

On July 12, 2024, the S&P 500 set an intraday record high of 4,818.70, surpassing its previous intraday record of 4,818.62 set in January of 2022. This could tempt short- and medium-term traders to jump into traditional markets to follow the trend.

Other Notable News

In late April and throughout May of 2024, the market was on edge, anxiously awaiting the release of the updated CPI numbers, fearing another rise in inflation. Both high inflation and interest rate environment could be catastrophic for markets, as raising interest rates is the Federal Reserve’s main (and only) defense against high inflation.

Despite the scare, most market analysts are predicting two Federal Reserve rate cuts by the end of 2024, amended from the previous predictions of 3–4 by year’s end. This is, of course, dependent on inflation rates remaining steady.

A Trump presidency would likely be positive for the cryptocurrency industry, and Bitcoin rallied over the weekend after the former president survived an assassination attempt. Iconic photos have emerged of him fist-bumping from the podium with fresh blood still streaming down his cheek. This, alongside calls for President Biden to step aside after his mental acuity has come into question following the most recent debate, could be positive for the crypto industry.

The return of GameStop alongside BTC making new highs is starkly reminiscent of 2021 and indicates that retail investors maintain a strong voice in markets.

Uncertainty related to regulatory concerns has stifled innovation to some extent, as no one wants to roll out their new protocol only to have it regulated away. Most VC investments have been backing projects focused on regulatory-friendly protocols.

Stay Grounded in Reality and Utilize Technicals

Bull market amnesia is a term to describe a temporary psychological condition associated with trading during market rallies. This phenomenon is universal, affecting all asset classes and markets, but it’s particularly prevalent among retail traders.

Symptoms of bull market amnesia include mild euphoria, periodic episodes of amnesia, denial of the laws of physics, trading tops, increased perspiration, nausea, and possibly even vomiting. Currently, an incredibly low percentage of portfolios are operating at a functional loss due to the elevated prices of the recent rally.

Those with symptoms of bull market amnesia should get plenty of rest, exercise, eat well, drink lots of water, and simply wait for the next rally — a.k.a. become hodlers. Regardless of any short-term psychological phenomena or what happens in the daily news (which is essentially another short-term psychological phenomena), it’s important to remain grounded in the reality that Bitcoin was trading at the $30,000 levels in July of 2023 (and has roughly 2X’ed since then) and the $20,000 levels in July of 2022 (and has roughly 3X’ed since then). Simply put, keep everything in perspective and never forget where we came from.

From a technical perspective, we’re trading in uncharted territory, and new levels are currently being established. Long-term support still sits around $31,500 because this is where BTC came from, and it’s still possible the price of the asset revisits these levels in the mid term.

Further supporting these levels is another important, but often overlooked, factor: forced technological innovation via the halving, i.e., the price at which only the latest technology can profitably mine BTC.

During the crypto winter, the bottom coincided almost perfectly with the price at which only the latest cryptocurrency mining technology, Application-Specific Integrated Circuits (ASIC) — typically the AntMiner S19 Pro — could profitably mine BTC, just above $15,000. This assumes competitive power contracts held by publicly traded crypto mining companies, most of whom have secured contracts between 2 and 5 cents per kWh. Adjusting for the halving and simplifying the process, this price has theoretically doubled since rewards have been cut in half, putting the next forced upgrade level around $30,000–$40,000. This is yet another example of the genius of the Bitcoin protocol and creates a natural bottom for the price of the asset.

The true test for BTC in the short and medium term will be in determining the strength of the rally itself by evaluating the ETF investments’ ability to stabilize prices and reduce overall volatility, and to test the resolve of retail investors to hodl among the uncertainty and resist jumping to follow trends in the short term.

Bitcoin as an investment remains a hedge against inflation and a digital commodity. Until regulations arrive, it’s not yet functioning as an actual currency with use cases beyond as a store of value, at least in the United States. Therefore, if things were to stay as they are right now and the short-term news were to remain about high-profile sales and skewing mostly negative, there’s likely to be more downside in the coming months until more clarity arrives related to the election and possible regulations, which are highly unlikely to arrive in the middle of an election cycle. So, the next major developments for the entire crypto space may not arrive until late 2024 into early 2025.