Ethereum L2s in 2023: Trends and Observations

2023 was a wild ride for most crypto projects — it’s been a rollercoaster, and the crypto community is still trying to count the ups and downs. The team at cross-chain aggregator Rubic invites you to look at the significant trends that have shaped the landscape of the L2 solutions sector in 2023 and its interesting specifics.

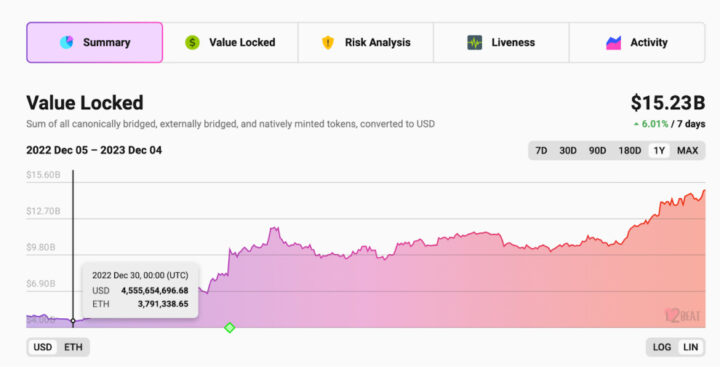

Layer 2 Total Value Locked Surpasses $15 Billion

At the beginning of 2023, Layer 2 TVL was just $4.5 billion. Fast-forward to today, and it has surged to an impressive $15 billion.

This increase in TVL is a testament to the growing significance of Layer 2 solutions. The crypto community is speaking volumes with its assets, and the numbers don’t lie — Layer 2 networks are shouting, “Hey, we’re onto something huge!”

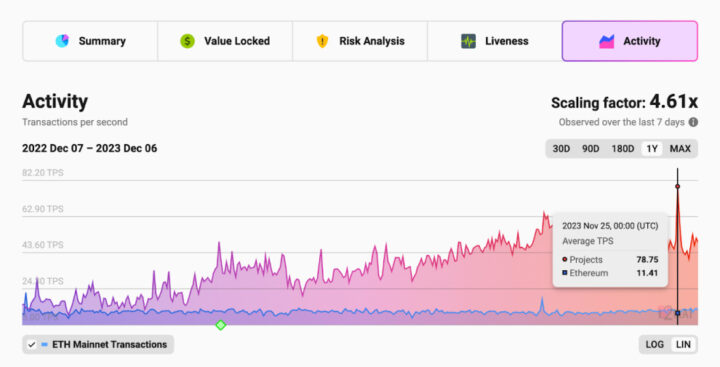

L2 Transactions Surge

Activity across Layer 2 networks is booming, with combined L2 throughput outpacing the Ethereum mainnet — sometimes by 600%.

In early 2023, L2 TPS was initially set at around 18. Over the course of the year, it has consistently increased, and now the average TPS stands at over 40.

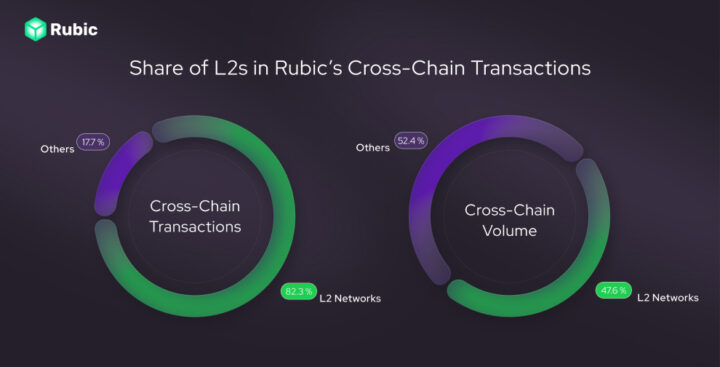

At Rubic, L2s already generate over 80% of all cross-chain transactions, with almost 50% of all transaction volume, although we support over 70 different networks, including non-EVMs.

The Layer 2 boom is real, and projects can ride the wave with transactions soaring higher and faster than ever before!

Transparent Airdrops Rules As Trend

Airdrops have been the main strategy for growing blockchain projects for years. However, the new trend is to reveal the rules of the game beforehand to engage more people and give clear instructions on how to increase your chances.

Take Mantle and Linea, for example.

Mantle has the Mantle Journey Campaign going on, and if you’re one of the early explorers in Mantle’s network, you get guaranteed rewards called MJ Miles. These miles act as XP tokens that show off your activity.

Users who complete tasks within the Linea ecosystem earn Linea Voyage XP. These non-transferable tokens stick with users, recognizing their efforts in boosting the Linea ecosystem.

However, Dune Analytics believes that airdrops are hardly a financially justifiable instrument. If you haven’t checked out this research yet, please do:

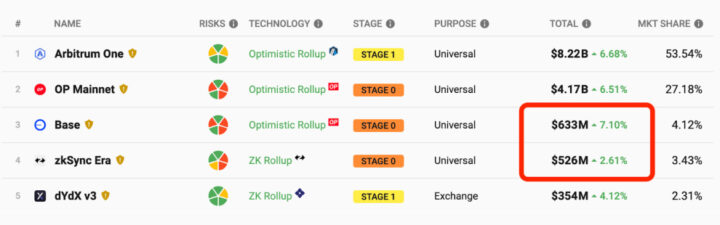

Base and zkSync Era: Challenging L2 Leaders

TVL serves as a key indicator of engagement in DeFi. As always, Arbitrum and Optimism lead the way, driving significant DeFi growth. However, Base and zkSync Era are actively competing for market share:

- Arbitrum One commands a dominant market share of 53.60%, with a TVL of $8.16 billion.

- OP Mainnet secures 27.08% of the market, with a TVL of $4.12 billion.

- Base holds a substantial market share of 4.15%, with a TVL of $631 million.

- zkSync Era captures 3.45% of the market, with a TVL of $526 million.

- dYdX, an exchange-focused platform, has locked $344 million, constituting 2.26% of the market.

Base has seen a whopping 7% growth in TVL over the last seven days. By the way, the market entry of Base and Mantle shows another interesting trend: Layer 2 networks are being integrated into centralized exchanges.

The quick growth of Base and Mantle highlights a successful strategy — having a strong name behind the Layer 2 solution. Base is supported by Coinbase, and Mantle is linked to Bybit. Fun fact: Base became the fastest network to reach 100,000 daily users!

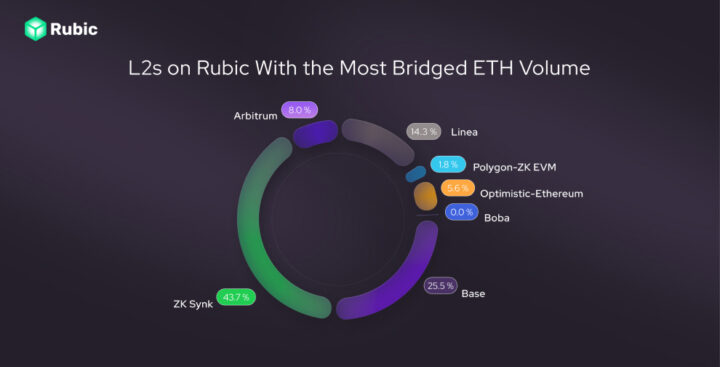

Who Bridges Most ETH

Here’s a peek at the L2’s TVB breakdown on Rubic.

Looking at the ETH Total Value Bridged on Layer 2, zkSync Era, Base, and Linea emerge as prominent leaders in bridged ETH over the past three months. Notably, zkSync Era contributes to almost half of the overall ETH Total Value Bridged on Layer 2. Additionally, the Base network claims second place in the ETH TVB rankings. This reaffirms the previously noted trend, highlighting an increasing demand for Base within the crypto community. Linea also shows good results!

Let’s recap. 2023 has been a year of vibrant growth in the Layer 2 ecosystem, setting the stage for continued innovation and development in the DeFi landscape.

For projects like Rubic, these trends spell good news, and we anticipate an even more significant impact in 2024. This surge is expected to catalyze a boost in trading volumes across various Layer 2 bridges and aggregators.

Current market reactions and subtle hints of a bull market whisper to us that the eagerly awaited L2 airdrops are likely on the horizon. This means a surge of activity that will make the times ahead even more exciting.