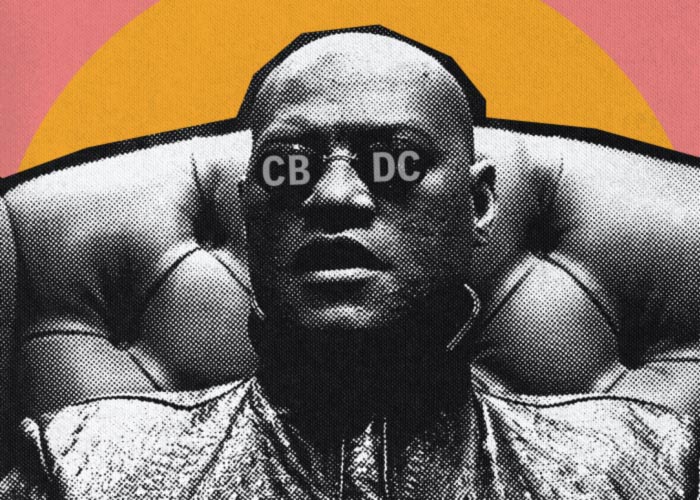

U.S. Authorities Plan to “Reset” the Banking System with CBDCs

Don’t you find what’s happening in the U.S. banking sector strange? On the one hand, the acute phase of the current crisis began in 2008 — the downturn of that period was never fully overcome. Moreover, the consequences of “quantitative easing,” a temporary solution at that time, are now one of the objective reasons for the destabilization of the banking system.

The point is that, purely technically, most banks in the United States right now are bankrupt as they hold the bulk of their assets in long-term Treasury bonds with a yield of up to 4%. Yet, the Fed raised the key interest rate by 25 basis points on February 1. After that, it ranged from 4.5% to 4.75% per year, and the rate over 4% was set on December 12, 2022. Therefore, such banks have been generating a net loss for some time now since the value of money received from the Fed as loans turns out to be higher than the income received on Treasury bonds that form the basis of their portfolio.

The U.S. banking system “got hooked” on long-term Treasury bonds precisely after the events of 2008, when the Fed was forced to lower the interest rate to 0.25%. But things changed in 2022, and it looks like the U.S. authorities are trying to “reset” their banking system. Why would they want to do that?

- Banks kept investments in the real sector to a minimum because they’re riskier and require more effort compared to the guaranteed returns of Treasury bonds.

- To keep the banking sector afloat, the debt ceiling needs to be raised further, which is a factor of constant political pressure on the government.

- The banking sector, meanwhile, is a costly and ineffective tool for controlling the public through loans. For example, commercial banks accounted for only $2.5 trillion out of $13 trillion in mortgage debt and $2 trillion out of $4.8 trillion in total consumer loan debt at the beginning of 2023.

Given this situation, considering renovating the existing banking system makes sense. But how to do it? Well, it’s easy since there’s already a more convenient and modern financial instrument — a central bank digital currency (CBDC). The only thing left is to discredit cryptocurrencies, which are a better alternative to CBDCs for ordinary citizens, and carefully upgrade the existing banking system without collapsing the dollar.

This logic fits perfectly with all the events taking place over the past year, including the collapse of major cryptocurrency projects, notorious public lawsuits, political initiatives to develop crypto legislation, aggressive actions by regulators against cryptocurrency projects, and now shutdowns of crypto-friendly banks.

There are many uncertainties in all this, but the closure of Silicon Valley Bank and Signature Bank by regulators as “precautionary measures” and the “voluntary liquidation” of Silvergate Bank raise the most questions. Some of them are even being asked out loud already. But who cares? After all, this is a great opportunity to achieve several goals at once: to tighten the screws on cryptocurrency companies and shake up the banking system to identify its most unstable elements. It’s better to do this in a controlled manner than to wait for things to develop spontaneously. So, it turned out that shaking up the market exposed the least stable banks, which no one is going to save this time. Only depositors are promised help. Probably, the “help to depositors” will become a narrative that will win public approval to implement CBDCs in the future.

What’s happening is just a trial balloon. In the U.S., no ready-made CBDC system yet exists at the national level, and the voices of those opposing technology are actively heard at the highest levels. Congressman Tom Emmer said in a speech at the Cato Institute in Washington that the programmable CBDC is a threat to the financial privacy of U.S. citizens. According to the politician, CBDCs could be “easily weaponized” into surveillance tools and suppression of political opponents. Concerns about citizens’ financial privacy when it comes to implementing CBDCs were also expressed in a report for the American Enterprise Institute by Christopher Giancarlo, Former Chairman of the Commodity Futures Trading Commission (CFTC).

But what if there was a small exemplary controlled crisis? Of course, the interests of the common depositors would be affected, and CBDCs would be offered as a tool to protect their interests. It’s a standard scheme — to create a problem and propose solutions that in another situation would cause active protests, but with this wording of the question, people will beg the authorities to implement CBDCs. In this case, the voices of critics and individual protests can simply be ignored, and the lack of your own technology is no problem. Firstly, certain developments still exist, and secondly, representatives of the Bank for International Settlements (BIS) would probably willingly share the results of their experiments.

In a word, the U.S. authorities seem to be paving the way to renew the existing banking system by introducing the digital dollar with stricter control over the crypto market. One can expect this scenario after the next U.S. presidential election. Unless Republicans come back to power, of course.