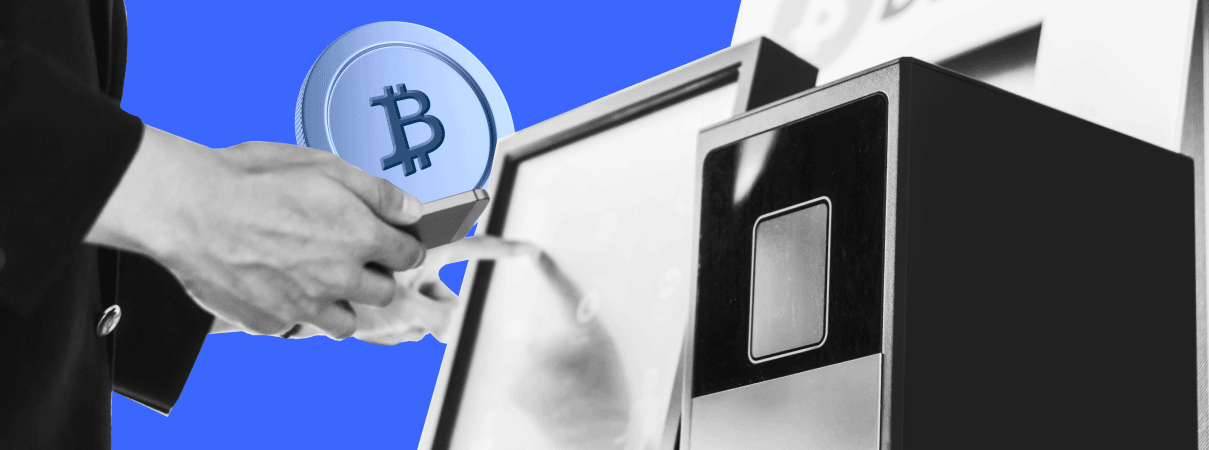

The EU banking regulator is setting minimum capital and liquidity requirements for local stablecoin issuers to address potential risks of collapse in a volatile market.

The European Banking Association (EBA) has published a new set of recommendations under the MiCA bill for stablecoin issuers that operate within the European Union.

The new recommendations involve setting minimum requirements for stablecoin issuers to ensure:

- Full redemption of any amount of coins at the declared denomination at the request of investors.

- Rapid redemption of coins even in a volatile market.

The regulator plans to conduct stress tests for stablecoin issuers, which will demonstrate compliance with the requirements put forward. According to the EBA analysts, this approach will help reduce the risk of dramatic outflows of bank liquidity and the spread of crisis phenomena, and token issuers will be able to better manage their reserves.

Under the new recommendations, the EBA or the relevant competent supervisor will have the authority to impose increased requirements on the issuer if the results of the liquidity stress test are unsatisfactory.

At this stage, the EBA’s recommendations are posted publicly, requesting a public consultation that will last three months. At the end of January 2024, the recommendations will be presented at a public hearing, after which they will come into force.

European regulators are seeking public opinion on a number of aspects of the new MiCA legislation, which will take effect next year.