SEC Vs. Crypto Industry: The Final Standoff and Its Reasons

The Securities and Exchange Commission (SEC) gradually usurped the right to regulate the cryptocurrency market in the United States, taking advantage of the uncertainty in this issue, the flexibility of the Howey Test interpretations, and the lack of desire of the crypto industry members to mess with the authorities.

Ripple Labs was the only company to fight back legally in response to the regulator’s claims. The Ripple vs. SEC lawsuit, started in late 2020, is nearing its conclusion, and the crypto company stands a good chance of proving that XRP isn’t a security and, what’s more, the SEC has been aware of it. In addition, William Hinman, Former Director of the SEC, said in a memo that ETH isn’t a security. In late May, the court ordered the registrar to disclose those documents as they could affect the final decision in the case. If the court takes Ripple’s side (and the chances of that are already quite high), it’ll set a precedent and seriously undermine the SEC’s ability to “regulate” the cryptocurrency market.

Ironically, Ripple Labs spent $200 million during the proceedings and expressed a willingness to settle by paying the SEC up to $250 million in fines, but only if the regulator publicly acknowledges that XRP isn’t a security. Needless to say, this won’t do for the SEC.

What does the SEC do in this situation? They play an all-or-nothing game by filing lawsuits against major industry players like Binance and Coinbase. The regulator has previously tried similar actions against smaller crypto exchanges such as Kraken, Bittrex, and stablecoin issuer Paxos. And in 2022, the regulator carried out 30 enforcement actions against cryptocurrency companies, recovering $242 million in fines. In other words, they were preparing all this time.

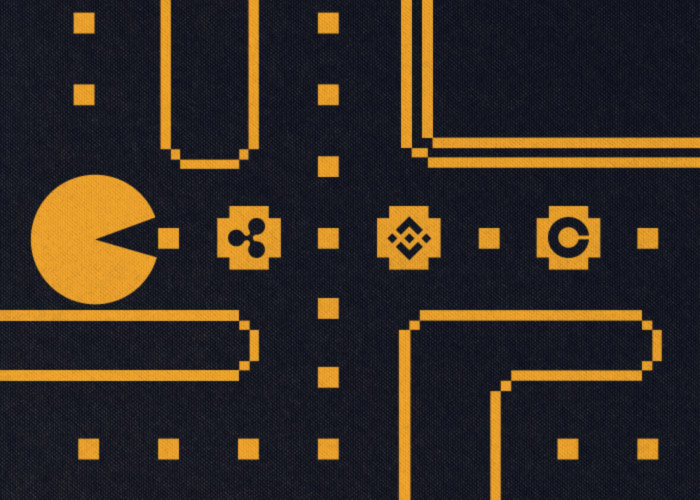

The lawsuits against Binance and Coinbase probably were also prepared in advance, and the trials were initiated now to deprive the crypto exchanges of the opportunity to use the precedent that may arise after the end of the legal battle with Ripple in the future. But what is this, if not the final showdown for the U.S. cryptocurrency market? Coinbase is the largest exchange in the local market, and Binance is the world’s biggest international trading platform. The two giants, the final bosses, to put it in gaming terms.

But why would the SEC need this? Here are the main versions:

- Collect large fines. This is the most trivial option. For example, representatives of Kraken officially got away by paying $30 million. How much can they get from Binance and Coinbase? This is a rhetorical question.

- Get access to the internal documents of the platforms. The regulator already requires Binance to provide a complete list of client assets of Binance.US, including their personal data. And these demands are quite interesting since if Binance agreed, they’d automatically admit to mixing client and corporate funds and thereby sign off on the part of the SEC’s accusations.

- Political pressure on the platforms’ management. It’s definitely possible with Changpeng Zhao because the alleged ties between Binance CEO and the PRC authorities have long been popping up in the media. By the way, such attacks on CZ were previously attributed to Sam Bankman-Fried, who was in close touch with Gary Gensler, Chair of the SEC.

- The SEC is trying to deflect attention from its role in the collapse of FTX and regain the confidence of its Washington superiors. Taking into account the aforementioned relations between the heads of FTX and SEC, that version has a right to exist too. What’s really ironic is that it was publicly stated by Brad Garlinghouse, CEO of Ripple Labs.

- The regulator is clearing the way for the digital dollar (CBDC) implementation. This is the most conspiracy version voiced in the public arena by Charles Hoskinson, Founder of Cardano.

There’s probably an overlap of all versions, so why limit the goal-setting of such a large-scale process? Furthermore, the last version, despite its conspiracy nature, looks like one of the key ones, being a continuation of the policy aimed at shaping public opinion. We’ve already discussed the problems of the U.S. banking system in this context. This could be the next step. The average user isn’t inclined to understand the details, they hear “government representatives sued a crypto company” and draw the most obvious conclusions. Their trust in cryptocurrencies sinks. Besides, it provokes an outflow of funds from affected platforms, creating liquidity problems and tightening the noose around crypto giants’ necks, while the SEC sticks to saying, “We told you so.”

What can be offered as an alternative to traditional banks and cryptocurrencies? The CBDC. But if such a plan exists, its implementation has clearly failed so far. Representatives of Binance and Coinbase snap back and promise active defense. The vast majority of the cryptocurrency community has taken the side of the exchanges in the information field. There’s no panic outflow of funds from the accounts of Binance and Coinbase, so the regulator hasn’t succeeded in undermining their stability. Big businesses also demonstrate their obvious attitude to the situation; for example, ARK Invest bought Coinbase shares for $21.64 million, benefiting from the fall in their value amid the news. The fact that institutional investors and venture capitalists actively “bought out the fall” triggered by the SEC’s actions is also reported by Lookonchain analysts. Against this background, only 16% of U.S. citizens support issuing the digital dollar so far, while 74% strongly oppose it, Cato reports.

So whatever goals the U.S. regulators pursue, the situation so far isn’t in their favor. But if this is indeed the final confrontation, then the parties obviously don’t intend to give up. We’ll keep an eye on the situation.