Top 2024 Trends in Web3

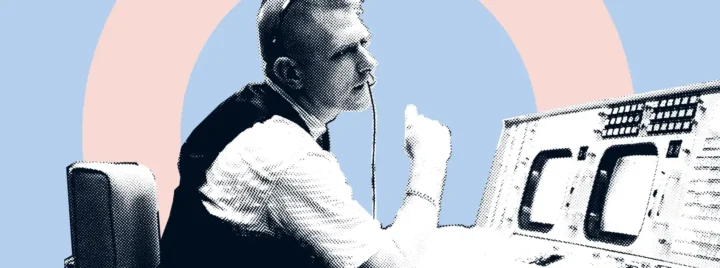

What aspects of the blockchain industry will be most active in 2024? What Web3 technologies are likely to become key growth points for the crypto market in the foreseeable future? What trends seen at the end of 2023 could turn into major trends next year? To answer these questions, CP Media approached industry experts, who shared their opinions and predictions.

Note: The content is for informational purposes only and reflects the personal views of experts, not those of their employer or any affiliated company. It is not intended to provide legal, tax, investment, financial, or other advice. Readers are encouraged to perform their own due diligence and consult with professional advisors before making any investment decisions.

Greater Crypto Integration Into Traditional Financial System

Anton Toroptsev, Regional Director of CommEX, believes that in 2024, the trend will be towards services that bridge the traditional financial system and cryptocurrencies — universal multifunctional apps that support both fiat balances and crypto.

Markus Kraus, Financial Expert, Author of the thematic blog Trading Verstehen, shared a similar opinion. He thinks that one of the already observed trends heading into 2024 is the growth of institutional adoption. The key drivers, in this context, will be regulatory changes and technological advances in blockchain.

“As for Web3, expect wider adoption across industries. Core changes may include improved user interfaces for mass adoption and integration with traditional finance,” says Markus.

Austin Hair, Managing Partner at Leaders Real Estate, also sees the gap between traditional finance and the blockchain sphere narrowing in 2024. Tokenization will contribute to the process, the expert said.

“We may see traditional financial institutions embrace tokenization to offer innovative products and services, taking advantage of blockchain while providing a familiar environment for their customers,” Austin adds.

Tokenization Could Be Game Changer in Real Estate and Other Industries

Austin Hair also identified asset tokenization as one of the major trends of 2024. He believes the process of converting the rights to assets into digital tokens on blockchain could revolutionize various sectors, especially real estate.

Austin listed several benefits of tokenization and the processes observed nowadays that are likely to lead to the active development of this technology in 2024:

- Tokenization will make high-value assets more accessible to ordinary investors. By breaking down assets such as real estate into smaller, more affordable shares, tokenization democratizes investment opportunities that have traditionally been available only to high net worth individuals or institutional investors.

- One of the most significant benefits of tokenization is the potential for increased liquidity. In 2024, we may see more platforms and exchanges supporting tokenized assets, making it faster and easier to buy and sell, thereby solving the liquidity problems often associated with certain assets like real estate.

- Tokenization of real estate is already gaining momentum, and in 2024, this process could extend to other asset classes such as art, collectibles, and even intellectual property. This diversification will offer investors a wider range of investment options, further boosting the popularity of tokenization.

- As governments and regulators around the world begin to provide clearer guidelines and frameworks for digital assets, it’s probable that adoption and trust in tokenization will grow. Clear rules will encourage more major investors and institutions to participate in tokenized asset markets.

- Tokenization improves transparency and security of transactions. In 2024, as technology advances, we can expect even more robust systems to emerge, increasing the trust and efficiency of transactions using tokenized assets.

“Tokenization could be a game changer in various industries, offering better accessibility, liquidity, and efficiency. Integration opportunities with traditional financial systems and a wider range of tokenized assets will probably make tokenization a trending segment in the cryptocurrency market in 2024,” Austin concludes.

Ronen Cojocaru, CEO of FinTech platform 8081, also mentioned tokenization among the major trends in 2024:

“Tokenization is shaping up to be a transformative trend, connecting the physical world and blockchain. We’re seeing big changes in sectors such as real estate, identity, art, and media where physical assets are being tokenized. This transition not only secures ownership rights but also offers a trusted solution compared to traditional digital segments or paper-based systems. Tokenization has the potential to revolutionize asset management and ownership, providing transparency and efficiency.”

Alexandra Korneva, CEO of cross-chain aggregator Rubic, is also confident that 2024 will see a lot of buzz around RWAs, real-world assets issued in the form of tokens on blockchain.

Sascha Grumbach, Founder and CEO of Green Mining DAO, predicts that asset tokenization technology will evolve, making new investment opportunities with equity ownership and programmable features available. The expert believes that the growing interest in tokenization by multinational financial institutions will lead to an increase in the volume of digital bonds issued and make this area more attractive to institutional investors.

“We anticipate increased regulatory scrutiny and guidance on tokenized assets, with regulators bringing clarity as these markets develop. Furthermore, crypto-asset accounting rules will further improve, increasing transparency and encouraging mass adoption,” predicts Sascha.

Another important trend for 2024 in tokenization, says CEO of Green Mining DAO, will be for the related platforms to support the needs of buyers and capital providers, rather than asset creators. Regulatory guidance in this area is also expected to keep advancing as tokenized asset markets gain popularity and present investors with a more diverse set of rights.

“Banks in the U.S. will likely move to tokenized payments in 2024, building on the efforts of large financial institutions and payment processors to adopt and use these technologies,” Sascha concludes.

Web3 in Carbon Credit Marketplace

Daniel Kennedy, Director of Mercurity Fintech Holding, named the use of DLT networks to capture the validity and quality of carbon credit processes and the issuance of tokens to accurately represent the value and facilitate carbon credit trading as one of the upcoming trends in 2024.

“The global market for carbon credits is substantial, as companies and sovereign nations around the world are required to offset carbon emissions. However, this process, as with cryptocurrencies, is poorly regulated on a global scale, falling under local control only. This naturally leads to conflicts and inconsistencies. These inconsistencies were exploited in the practice of “double counting,” and there’s a general lack of clarity around this trade. Blockchain can solve the problem by offering an immutable and detailed record of the lifecycle of each individual carbon credit, including tracking the carbon footprint related to the creation of the carbon credit itself and issuing tokens of value to investors to provide greater clarity, transparency, and fair trading. Blockchain and token issuance could change this process and result in a whole new sector in the global market,” predicts Daniel.

L1, L2, and L3 Network Development & Cross-Chain Protocols

David Winkels, Communications Specialist at ICON Foundation, thinks that the market in general will continue its journey towards increased interoperability. According to the expert, this will be largely due to cross-chain technologies beyond the EVM stack.

“The ability to seamlessly connect different blockchain networks will be key to creating a more inclusive and efficient cryptocurrency ecosystem. This trend is likely to reduce market fragmentation and create new opportunities for both users and developers,” says David.

Ronen Cojocaru, CEO of 8081, believes that the development of L1 blockchain networks will play a crucial role in the deployment of scalable and efficient Web3 solutions.

“L1 acts as a foundation layer for a variety of apps, each of which is intended for a specific purpose. In the context of global crypto adoption, Layer 1 is critical to enable cross-network payments, improve security, and facilitate the use of different applications. It’s the driving force that connects multiple protocols and networks in a single blockchain ecosystem,” Ronen believes.

Alexandra Korneva, CEO of Rubic, also believes that in 2024, the crypto market will evolve due to the growing interoperability of various blockchain networks. She says that this process will be partly driven by the release of airdrops of projects such as zkSync, LayerZero, and others. This will contribute to increased engagement from users and higher trading volume.

Anton Shustikov, CEO of CakesCats, expects the development of Layer 3 solutions and cross-chain protocols. This will be one of the drivers of wider crypto adoption by the public and push the development of new blockchain use cases in narrower business niches.

“There’s likely to be a major refinement of the tech stack, a lowering of the entry threshold into the industry, and the emergence of services or toolkits for a broader audience. Currently, active discussions are going on within the community about which technologies are better suited for what, so we can expect the most viable ideas to be selected,” Anton comments on the situation.

Stablecoin Market Growth and Ecosystems Based on Stablecoins

Sascha Grumbach, Founder and CEO of Green Mining DAO, considers that the distribution of stablecoins and related products and services is probable to increase in 2024. Various stablecoin projects will seek to replicate the success of stablecoins pegged to the U.S. dollar, such as Circle and Tether products. Despite the new entrants, USDC and USDT can still maintain market dominance due to their compatibility, network effect, and established reputation.

“In 2024, Tether may face a turning point where increased regulatory scrutiny could lead to an audit or deplatforming. The challenges the company is currently experiencing, including regulatory issues and delisting, could affect its market position,” Sascha said.

SFT, NFT, AI, DePIN, and Other Sectors

Denis Astafyev, CEO of investment company SharesPro, identified several distinct segments of the cryptocurrency market that may be trending in 2024:

- Sectors of SocialFi projects.

- Protocols based on zero-knowledge proof (ZKP), including ZkSync, Strknet, Aleo, and others.

- The GameFi sector and related NFTs and gaming tokens. Immutable X is the flagship company in this area.

- The decentralized physical infrastructure networks (DePIN) sector, especially the Hivemapper and Helium projects.

- Web3 projects with AI.

- New projects in the Bitcoin ecosystem.

- Real-world asset tokenization protocols.

Other experts interviewed by CP Media also commented on the prospects for some of these sectors.

SFT and Currency of Future

Christopher Smithmyer, Co-Founder and CEO of Black Wallet Limited, sees crypto tokens as the currency of the future. He notes that their second-by-second arbitrage capability makes them more convenient for everyday transactions.

“KIROS, the first stablecoin 2.0, maintains the relative value of a basket of goods, avoiding the inflationary “tax” on paper currency or stablecoins based on paper money. Even altcoins like SOL and PI have great potential to be the “people’s currency” rather than BTC and ETH, which are likely to become a store of wealth for billionaires. The highest levels will use BTC and ETH, institutions will favor altcoins, and everyday transactions will involve people-friendly tokens such as KIROS and USDT,” Christopher predicts.

The expert says that this will lead to the mass adoption of stablecoins and steady growth and demand for altcoins, BTC, and ETH. However, Christopher draws special attention to semi-fungible tokens (SFT).

“SFTs will reshape several areas, such as derivatives and equities. This technology is noteworthy. While a user considers them completely fungible, the industry has a way to deal with them individually. This makes it possible to track sales, measure token movement, and create a whole new industry of big data. Although it may not happen in early 2024, this is a large segment to keep an eye on in late 2024 or early 2025,” says Christopher.

NFTs and Real-World Applications

Steven Feiner, CEO of ABF Group, believes that the primary focus in 2024 will be on NFTs, tokenization, and real-world applications.

“The cryptocurrency world is about to merge with the real world. Real-world applications are starting to materialize, be it tokenization, tangible assets, or the increased use of non-fungible tokens. Blockchain may enter a revolutionary stage in 2024, when it begins to leave the digital world and have a real, visible impact on society,” the expert predicts.

Deeper AI Integration

Alexandra Korneva, CEO of Rubic, notes the growing interest in AI. But she states that there are no vivid examples of using artificial intelligence in crypto projects yet, but a breakthrough here can be expected in 2024.

This forecast is complemented by Daniel Kennedy, Director of Mercurity Fintech Holding, who noted that the process of mass adoption of AI will accelerate as more synergies associated with previously incompatible Web3 apps emerge. The expert says this is already evident in the partial repurposing of ASIC manufacturers into AI processors.

Ronen Cojocaru, CEO of 8081, states that AI technologies are already playing a versatile role in the Web3 industry, from improving trading strategies to enhancing security. Among other things are:

- AI algorithms can already identify suspicious patterns and fraudulent activity, enhancing the protection of digital assets;

- AI-based research tools can analyze complex market dynamics, offering a more complete understanding of the processes involved than existing tools;

- advanced AI models can analyze market trends and predict potential market movements;

- neural networks can analyze public sentiment on social media and publications on news resources, providing a more holistic view of market sentiment.

“In 2024, the synergy between blockchain, tokenization, FinTech innovation, and AI will not only shape the trajectory of the crypto market but will revolutionize the way we interact with digital assets and financial services,” Ronen summarizes.

A less optimistic opinion on the matter was expressed by Anton Shustikov, CEO of CakesCats, who believes that in 2024, amid the new hype, the market may see a series of scams in the crypto AI sector.

FinTech Platforms Based on Web3

Financial technologies based on blockchain are another segment experiencing rapid growth, says Ronen Cojocaru. He notes that there are many new apps emerging that offer financial solutions customized for the Web3 sphere and the cryptocurrency market. These technologies simplify trading and management of cryptocurrencies.

Dmitry Noskov, Expert at StormGain, also believes that in 2024, Web3 can provide higher reliability and security for new digital solutions, particularly in financial markets. This includes the prospects for national digital currencies (CBDC). Moreover, Dmitry says that in 2024, there may be finalized and implemented a secure access key and a single user account to which different services, such as a digital wallet, can be linked.

Struggle for Crypto User Identification

The main legal trend of 2024 in the crypto market is to strengthen the fight for the identification of crypto users and international exchange of their data so that the state can control the flow of funds, carrying out anti-money laundering, tax collection, and anti-corruption and controlling the financing of political projects and beyond. This opinion was expressed by Natalia Kordyukova, Consultant on Taxation and FEA, and supported by the facts set out below.

In November 2023, 48 countries confirmed their willingness to exchange data on crypto turnover under the Crypto-Asset Reporting Framework (CARF) approved by the OECD Committee on Fiscal Affairs in June. These countries include Cyprus, Lithuania, Luxembourg, Malta, Singapore, and Switzerland.

The CARF is analogous to the CRS automatic exchange of financial information, a project developed by the OECD in 2014, to which the vast majority of the world’s major banking systems are currently connected. Instead of banks, the CARF regulates the activities of crypto market participants. The project’s essence is as follows:

- Service providers in the field of crypto-asset turnover (mainly exchanges) must collect data on users, including tax residency and data on their operations (transactions and currency exchanges), and provide this data to their local tax authority (at the location of the legal entity);

- In turn, the local tax authority transmits this data to the tax authority of the user’s country of residence (to verify their transactions and income).

The project is supervised by the OECD, encouraged by the FATF, and has good prospects for implementation. The planned start date is set for 2027, but the EU intends to launch it a year earlier. Given that the process requires customization of crypto service providers’ internal procedures, it’s safe to assume that by 2024, we can expect to see active regulatory movement in the market. That includes:

- forcing participants to tighten user identification and recording of their transactions;

- many scandals, demands, and harsh statements of regulators: political and media campaigns for and against “transparency,” with different degrees of aggressiveness;

- “flight” of some exchanges, especially small ones, to countries that didn’t join the CARF.

“The situation will eventually result in a categorical division of the single market into “white,” fully compliant with the requirements of “transparency,” and “black,” fully non-compliant, with the gradual disappearance of the segment in the middle,” summarizes Natalia Kordyukova.