Let’s find out what staking yields depend on, how to calculate the actual profit from staking, and what tools are available for it.

What Affects the Income Level

The staking yield depends on several factors forming the final amount of profit. These factors include:

- Nominal interest from staking. The amount expected to be earned by staking coins from a platform or validator.

- Commission. The fee is to be paid to the validator or platform that provides the cryptocurrency staking services. Commissions can be explicit or implicit, but they are always there. That’s why it’s worth carefully checking information about the price of providing staking services.

- Rate differential. The amount to be deducted from the total capital if the rate of the cryptocurrency that was sent to staking falls.

Analyzing the factors that affect staking yields will help calculate the actual return.

How to Calculate Actual Staking Yield

The actual staking yield is the amount that a depositor will be able to receive from staking, taking into account all fees and fluctuations in the cryptocurrency exchange rate. The actual yield can often only be determined after coins are withdrawn.

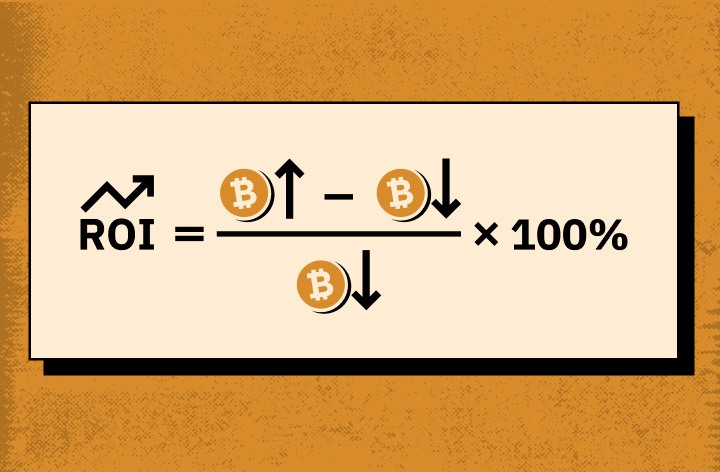

ROI (Return on Investment) is the ratio of return on investment. Its figures can form the basis for the staking profitability. ROI is calculated using a mathematical formula that considers the nominal number of coins in a stack and the change in the exchange rate when the asset is withdrawn from the stack.

To calculate the profitability of staking using the ROI formula, the nominal yield must be divided by the number of commission deductions and the resulting amount converted to a percentage. As for the application of ROI to crypto projects, much depends on the coin’s current and expected rate. If the asset’s value drops when it’s withdrawn from staking, the actual income may fall below zero and turn into a loss.

However, this does not mean that crypto staking is unprofitable. It should not be forgotten that cryptocurrency assets are highly volatile, making storing them a risky venture. Even without sending coins to staking, it is possible to suffer losses if the asset’s value falls. Staking, on the other hand, can help compensate for some of those losses.

Staking Income Calculator

Using calculators helps to compute the nominal profit from staking a particular cryptocurrency. Such profitability calculation tools divide digital assets into certain categories:

- Coins with a medium yield rate and high capitalization. Nominal staking yields of such crypto-assets range from 5% to 8%.

- Coins with a medium or high yield rate and medium-capitalization. The most numerous category, in which the nominal staking yield of crypto-assets can range from 5% to 30%. But keep in mind that the volatility of such assets is also often higher than that of high-cap coins. Accordingly, the chance of an actual negative return is much higher.

- Stablecoins. They are used for staking more often than others. Their nominal yield is usually about 10%, and the actual yield is hardly affected by any volatility factor.

Many specialized calculators are available to calculate the profitability of staking specific coins or projects. Such services are narrowly focused and often do not take into account the fees and volatility of cryptocurrencies.

However, there are also general-purpose services. Let’s take a look at the most popular tool for calculating staking profitability.

Staking Rewards

The Staking Rewards platform makes it possible to calculate the passive profits of the majority of crypto projects sent to staking. The platform provides data based on which an investor can minimize the risks of staking coins.

The platform contains information that addresses the most popular staking sectors and allows you to estimate individual rewards and the frequency of remuneration.

The platform’s main categories are:

- PoS tokens;

- Masternode coins;

- Dividend tokens;

- DeFi coins.

The platform enables you to compare not only individual cryptocurrency projects for staking but also Staking-as-a-Service (SaaS) platforms. Thus, Staking Rewards gives you the opportunity to compare the yield of staking on popular staking platforms or SaaS platforms for the selected coin.

Staking Rewards offers real-time tracking of metrics that affect staking profitability, including:

- capitalization;

- the asset’s market value;

- the number of blocked coins in staking in dollars and percentages;

- the percentage change in the asset’s value over 24 hours;

- a chart of the asset’s value change over the last seven days;

- the percentage of the estimated reward from staking in real-time.

Staking Rewards is the leading provider of crypto staking data. The platform tracks about 263 assets and around 41,000 staking platforms.

So, staking digital assets can be a great way to make passive income from cryptocurrencies, and calculating actual returns is a useful tool for making investment decisions. To maximize profits from staking digital assets, you should consider the volatility factors of cryptocurrencies and the fees of various staking platforms. Platforms such as the Staking Rewards profitability calculator can help make decisions about staking certain coins and calculate their nominal returns.