What Is Pump and Dump?

A pump is a sudden and rapid growth of an asset’s market price due to a sharp increase in trading volume. You might think: what does it have to do with fraud if we’re talking about market mechanisms? The truth is simple: a pump is supposed to increase the price as much as possible, and a dump is intended to bring it down.

This technique can be used independently or as part of a fraudulent Rug Pull scheme. If in the Pump and Dump, attackers simply blow up the value of shares of little-known companies and then cause them to crash, the Rug Pull scheme boils down to creators of a particular project building up an information frenzy about it, collecting money from “investors,” dumping the token price, selling everything at once, and quickly withdrawing funds to a safe asset.

How Pump and Dump Works

First, scammers cautiously purchase the asset from holders or create their own, and start to trade it between their addresses. Increasing demand pushes the price up, and “news” about the rise, articles, and reviews on the asset appear on all sorts of resources. Comments on social networks start multiplying messages about the profitable asset. Inexperienced bloggers jump on this information wave. All this motivates unprepared investors to buy the asset, and consequently, demand drives the price higher and higher. You’ve got yourself a pump.

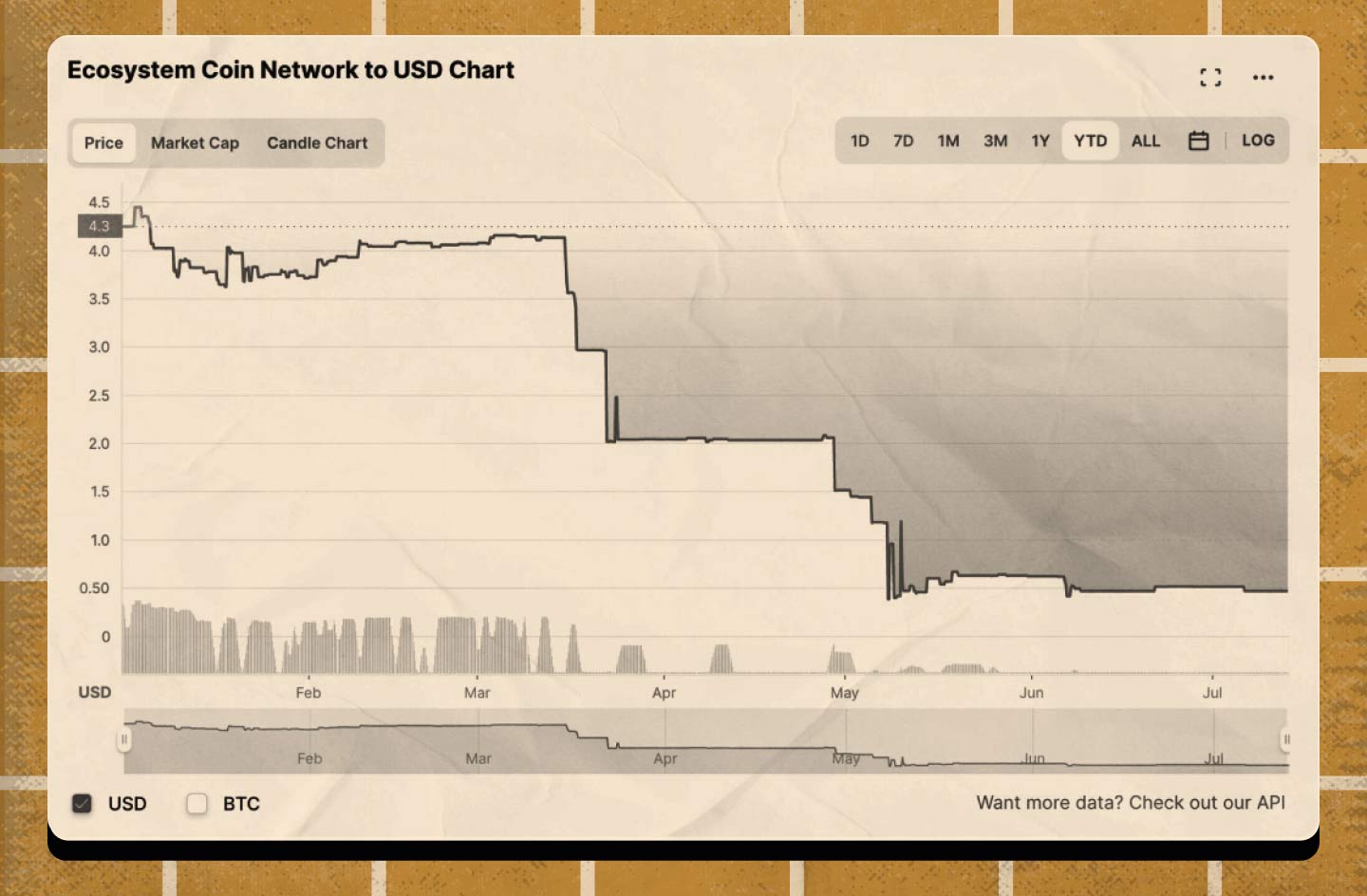

At a certain point, scammers who own a large amount of this asset sell its entire stock at its peak price. This triggers a massive sell-off on the part of “investors,” and supply drastically exceeds demand, causing the asset to plummet. This is a dump.

So, the Pump and Dump scam consists of several steps:

- Finding a little-known coin or creating a new asset.

- Activating the bidding and advertising campaign. Gradual “acceleration” of the price, attracting third-party users to the auction.

- Dump.

Types of Pumps

There are several types of such operations. They’re divided by regularity and price collapse.

By regularity:

- One-time pumps. The currency is pumped and falls only once in this case.

- Fluctuating pumps. When attackers are confident that the coin can make a profit more than once, the operation may be carried out two or three times. Three is the maximum number, as its forced fluctuations become noticeable and investors no longer trust it.

By type of collapse:

- Sudden dumps.

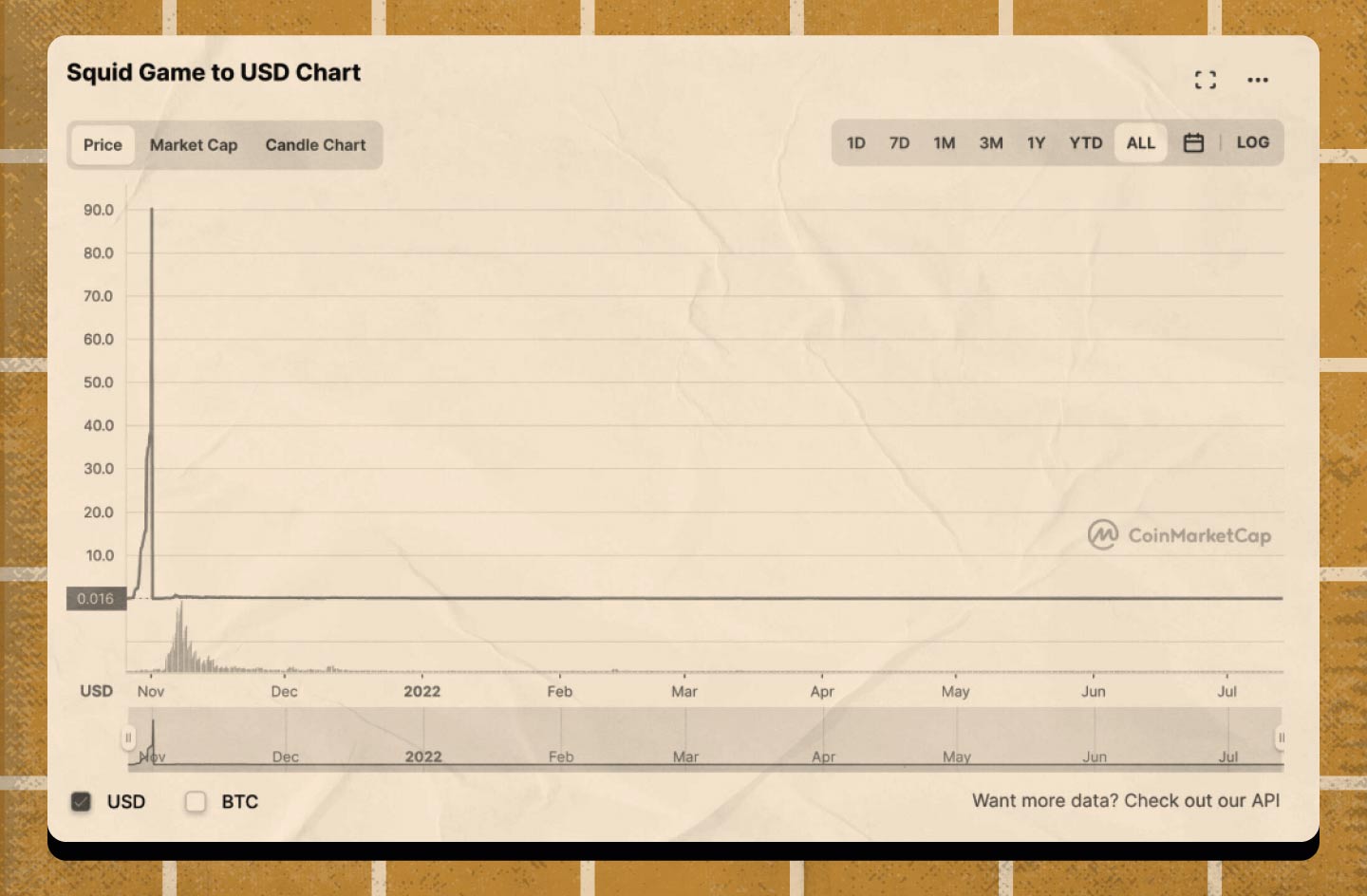

During a sudden dump, the coin can collapse in a matter of minutes. A good example is the Squid Game crash. Here, the Pump and Dump was part of a Rug Pull scheme, and the main trigger for user attention was the association with an extremely popular TV series.

- Gradual dumps.

In a gradual dump, the coin’s price drops slowly: this process can take several days or even a week. Here, attackers act cautiously, throwing in fakes little by little.

Signs That an Asset Is Growing Artificially

In order to recognize fraud and not get hooked by scammers, you must look closely at the trading dynamics and the asset itself, which suddenly went up.

A few signs of a pump:

- An unknown altcoin rises.

The growth of a little-known coin doesn’t always mean a pump, but scammers often choose it for several reasons. Firstly, even a small investment can change the rate of such a coin. Secondly, running a PR campaign for an unknown asset is far easier. Most newcomers find it quite challenging to verify the plausibility of information about a little-known project and find answers in official sources. Scammers are always counting on the FOMO effect, so you should never make hasty investment decisions. It’s better to miss out on making a profit than to lose everything.

- No growth prerequisites.

Typically, a coin’s growth is supported by official news from the project website or other formal sources: software updates, news about major partnerships, achievements, deals, and other events. So, if people “talk in secret chats” about the coin’s growth, it’s probably a fake.

- Significant increase in trading volume.

Trading volume increases only after meaningful events like those mentioned above. If it doesn’t happen and the trading volume increases several times, it’s most likely a scam.

Can a Pump Bring Profits?

In short, it’s almost impossible to make a profit on a pump. You can earn money only in three cases:

- you’re incredibly lucky;

- you’re familiar with the organizers of the Pump and Dump;

- you’re the organizer.

Please note that the organization of a Pump and Dump scheme is illegal. In fact, it’s outright fraud, as it’s directly related to enrichment through deception.

Is it worth a shot? CoinsPaid Media is categorically against such earning schemes, as we consider them immoral and unworthy of representatives of the crypto community. This material is for introductory purposes only and aims to improve the financial literacy of novice investors.

We wish you all peace, kindness, and great profits.